- Tags:

- coronavirus / COVID-19 / Japanese economy / recovery

Related Article

-

Retail staffer finally pushes back on overbearing customers [manga]

-

Office employee makes Evangelion A.T. Field clear partition as coronavirus protection

-

Japanese politicians suggest beef tickets, free masks will shield Japan from pandemic: residents disagree

-

Wife makes husband adorable Japanese pub menu since he can’t go out to drink

-

The Happy Science Religious Movement Claims to Hold the Cure for COVID-19

-

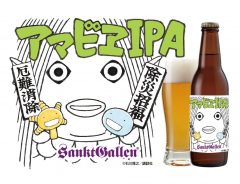

Japan now has “coronavirus-fighting” beer, Amabie IPA, with a label by “Moyasimon” creator Masayuki Ishikawa

If you follow economic news, you're likely aware that these are unprecedented times. The American federal government is implementing record levels of fiscal stimulus, and several governments worldwide are putting cash directly into consumers' hands. As furloughs and unemployment increase throughout countries affected by lockdowns, governments are forced to bail out almost every entity.

Nevertheless, despite dire economic forecasts and eye-popping unemployment figures, the American stock market is showing surprising resilience. Several markets have largely recovered from earlier selloffs and bizarre conditions which saw, at one point, oil futures trading in negative prices. Furthermore, several Big Tech stocks have recently hit record highs.

So, is the V-shaped recovery that optimistic investment strategists predicted all along beginning to play out? Unfortunately, any celebration in Japan, at this point, is likely premature.

Current Weakness

Although the fallout of the COVID-19 lockdowns may not have been as bad as initially thought, it appears Japan is in for a rough time. Indeed, the country could be facing its worst postwar recession due to the virus.

According to an article by The Mainichi Shimbun, a 7.3 percent economic decline in the October-December period of 2019 indicated that Japan had already entered recession before the outbreak. With lockdown conditions causing further contraction, analysts predict a rebound is unlikely while the pandemic continues.

These dire predictions, the article continues, contradict statements by prominent politicians in the Abe administration. The prime minister has been projecting confidence, saying, "I'll lead the Japanese economy toward a V-shaped recovery at a stretch, once social anxieties are dispelled." Other cabinet members have been similarly optimistic.

However, they stand in contrast to prominent economists. Yasuhide Yajima, chief economist at the NLI Research Institute think tank, has been much more measured in his assessment of the recovery. He cited the negative effect of social distancing policies as he downplayed the possibility of a full recovery. Yajima also pointed to various sectors likely to be hard hit by falling exports and drops in consumption.

Job Losses and Furloughs

Looking deeper into economic figures, it becomes more difficult to understand the confidence of the Abe administration. As a large portion of the workforce continues remote work, a notable amount has been furloughed or laid off.

The Japan Times reported that up to 3.01 million jobs could be lost in a year owing to the slowdown caused by the pandemic. This is a much greater impact than the global financial crisis of 2008, which saw 950,000 job losses in Japan. Furthermore, while job losses during the GFC were mostly limited to manufacturing, the fallout of the coronavirus will likely be felt across all sectors with retail, manufacturing, and accommodation and restaurants particularly hard hit.

Major employers are also sending home employees as plummeting demand leads to furloughs. Companies like IHI and West Japan are increasingly furloughing employees to cut back on expenses as they manage sudden revenue losses. Many companies doing so are associated with travel and are understandably reeling under the current conditions. While several have furlough workers domestically and abroad, employees are still eligible for 80% pay under Japanese law. Overall, the sectors remain reticent to lay off employees due to the likelihood of future labor shortages.

Tourism Sector

The Tourism sector in Japan has also been struck. While the country had been experiencing a tourism boom before the pandemic decimated the industry, the number of visitors in April was a measly 2900. That’s an eye-popping drop of 99.9 percent from a year earlier.

The effect has been so devastating that the government has announced it's considering subsidizing travel once the pandemic is over. While there was initially confusion about who would be eligible for the subsidies, it appears the program is limited to domestic travel. Via the Go To Travel initiative, the government plans to offer 20,000 JPY ($185) per day for leisure travel.

Other businesses are acting to attract local visitors. Achi village in Nagano Prefecture, for example, has developed a campaign that effectively forms a workaround of prevention measures in the Tokyo metropolitan area. Although hit by a decline in visitors from Tokyo, Achi village accommodations are offering discounted rates to residents of Nagano Prefecture. According to supporters of the initiative, it helps residents experience local culture while working to contain the virus.

Yet, it's hard to imagine limited domestic programs completely covering the shortfall. Tourism has been a significant source of growth in recent years, accounting for 2.4 percent of Japanese GDP and 6.9 percent of employment. The losses in this sector will likely need to be compensated for elsewhere. However, as coronavirus continues to stifle demand, alternate sectors for growth seem hard to imagine.